The cannabis sector, following a mixed regulatory response, continues to report growing adoption and sales, though delays to meaningful legislation in the US and inflationary concerns have put increased scrutiny on cannabis firms’ path to profitability.

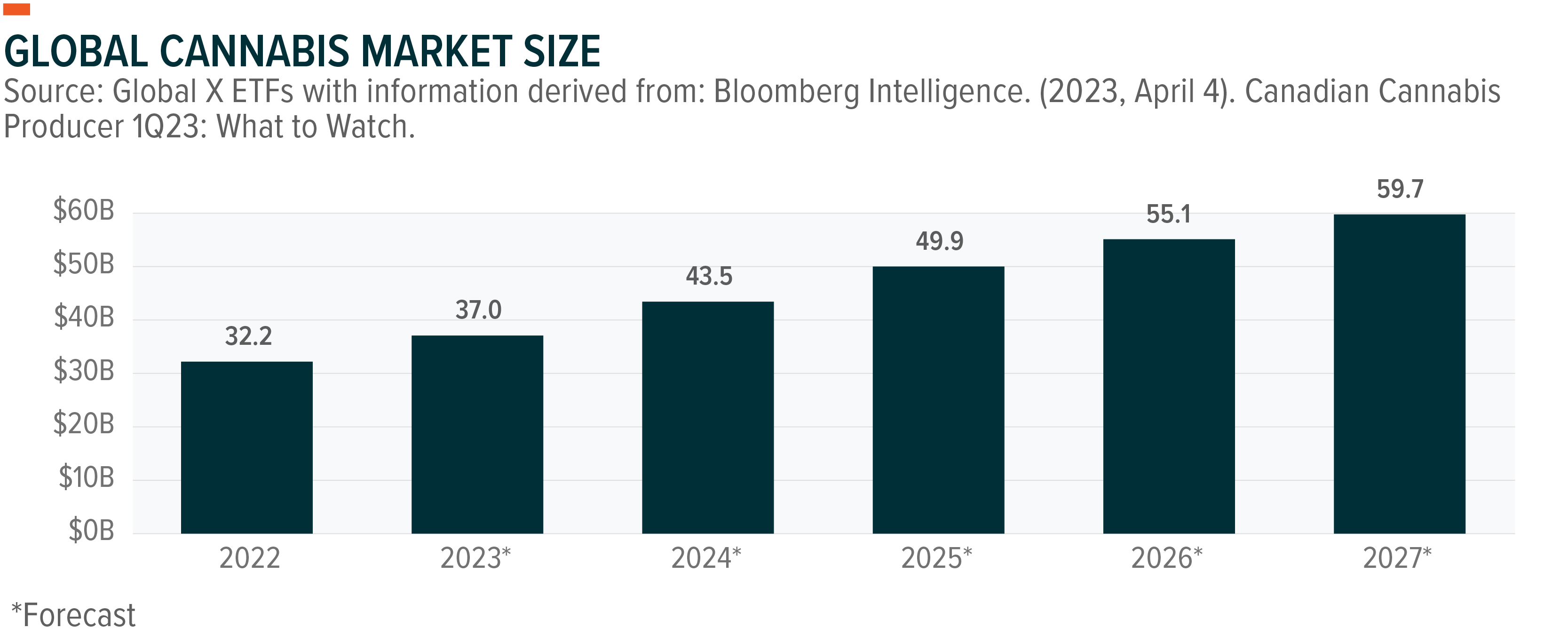

Worldwide legal-cannabis sales are expected to rise 15%, to $37 billion, in 2023, driven primarily by an anticipated 14% gain in the US as a result of increased adoption in legalized states or newly legal states.1 The US market is expected to make up 81% of global cannabis sales, even without federal legalization.2 The Canadian market is projected to see a 12% rise in 2023 sales, to $4.7 billion, accounting for 12% of global sales.3 North America’s dominance should decline in the longer term, we believe, with the next wave of growth emanating from Europe.

Key Takeaways

- A large illicit market and varied regulatory landscape have been headaches for the legal cannabis industry, but adoption continues to increase, and worldwide legal-cannabis sales could rise 15%, to $37 billion, in 2023.4

- Current operating conditions have cannabis companies focused on increasing efficiencies and positioning for potential legislative victories in the US.

- Internationally, supply chain dynamics continue to improve in Canada, and proposed legislation for the legal use of recreational cannabis in Germany could set the stage for broader adoption in Europe.

Canada

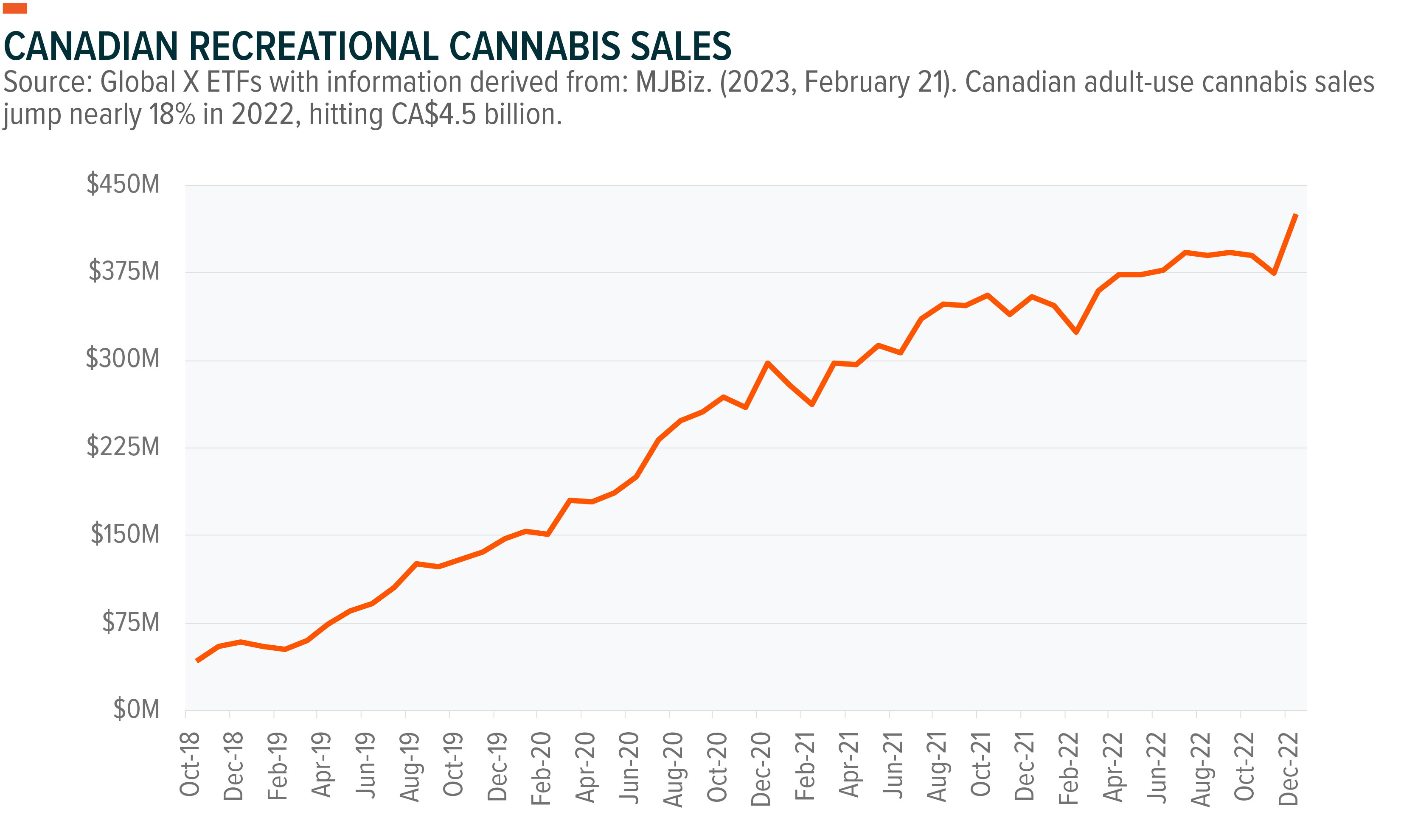

Supply chain dynamics for the legal cannabis market continue to improve in Canada, though the space remains subject to growing pains. Global legal cannabis sales are buoyed by a growing consumer base and improving distribution networks for cultivation and retailer licenses. However, in many markets, legal distributors are still competing against illicit markets. Five years after legalization, an estimated 33% of cannabis sales in Canada still derive from the illicit market.5 Often, licensed participants throughout the cannabis supply chain drastically cut prices to remain competitive against unlicensed products. This dynamic leads to compressed margins and earnings. However, we believe this is a short-term hurdle and that licensed growers will likely be able to increase prices significantly in the long term, once the market is consolidated and the illicit market is less of a concern. Notwithstanding the market’s growing pains, recreational cannabis sales at licensed stores continue to rise. In 2022, Canadians purchased a total CA$4.5 billion worth of cannabis.6

Canada-based suppliers are also keeping a close eye on legalization efforts abroad. Given ongoing consumer support for national legalization in the US, Canadian companies are increasingly refining their strategies to enter the US market via acquisitions. Merger and acquisition (M&A) activity has stalled in the last year or so, driven by delays to legalization in key markets. Canadian licensed producers are looking to quickly enter the US market and are prepared to ramp up Canadian production to import to the US upon legalization. Canopy Growth struck a deal in 2019 to acquire US-based Acreage Holdings if cannabis production and sale becomes federally legal in the US.7 Canopy announced in October 2022 it was accelerating their plans to enter the US market, with the intention for the acquisition to close by year end 2023.8 Tilray Brands, for its part, is focusing on consumer goods, but has noted M&A in the US market will be a priority moving forward.

United States Market

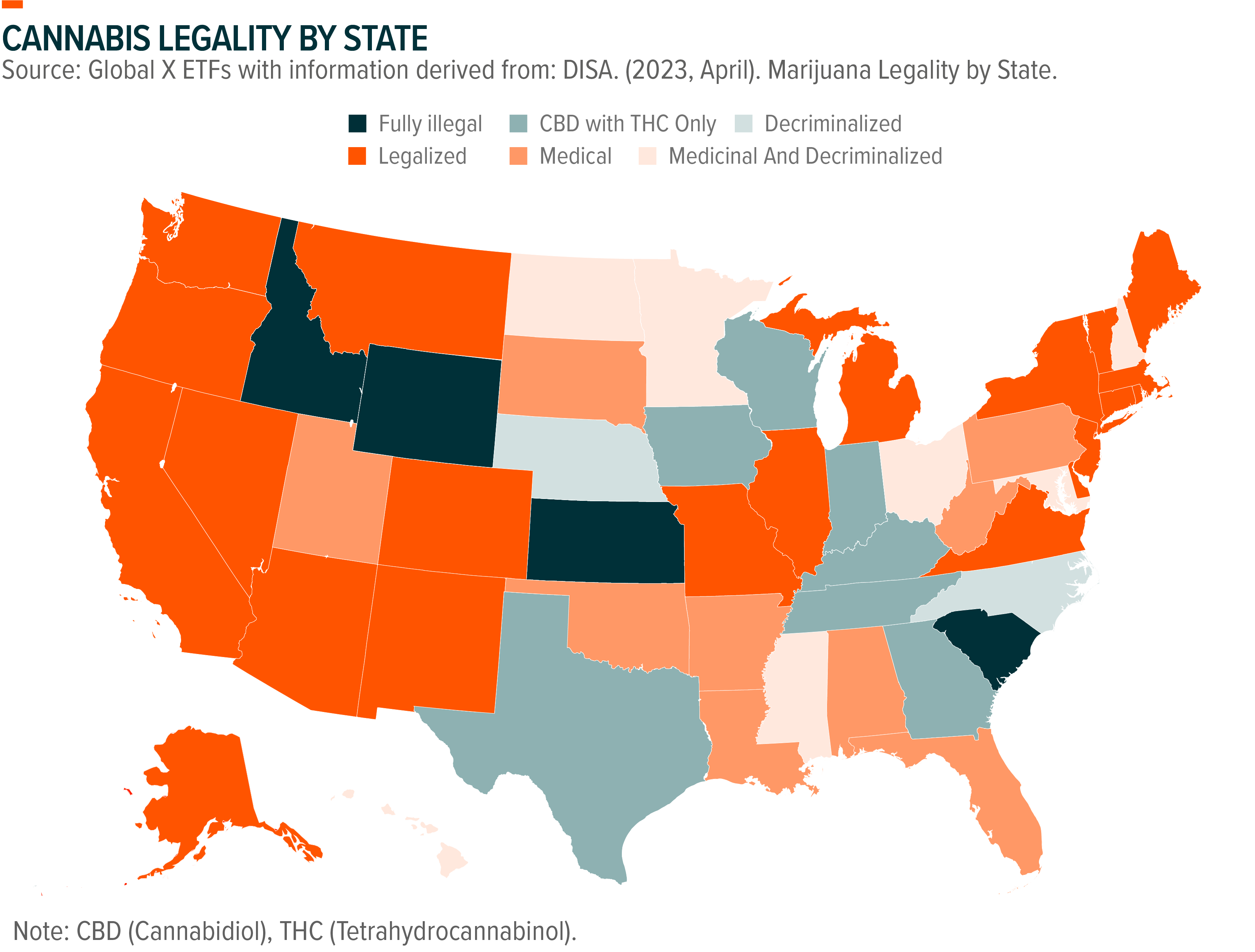

The US cannabis market has seen marked improvement via increasing legalization of medical and/or recreational cannabis at the state level. In a recent Global X study, two thirds of survey respondents supported the legalization of cannabis at the national level.9 President Biden’s move in October 2022 to pardon all federal offenses of simple cannabis possession speaks to the favorable shift in both legislative and public sentiment towards cannabis and is a positive step towards solidifying the nearly $40 billion US cannabis market. The move also clearly pointed to continuing consumer pressure to accelerate legislative efforts that have stalled in Congress. Congress re-introduced the SAFE Banking Act on April 27th, re-sparking hopes for its passage. The bill is designed to expand cannabis companies’ access to traditional banking services, which is severely limited at present because cannabis is still illegal under federal law. Bloomberg Intelligence currently places a 40% chance of its passing in 2023.10

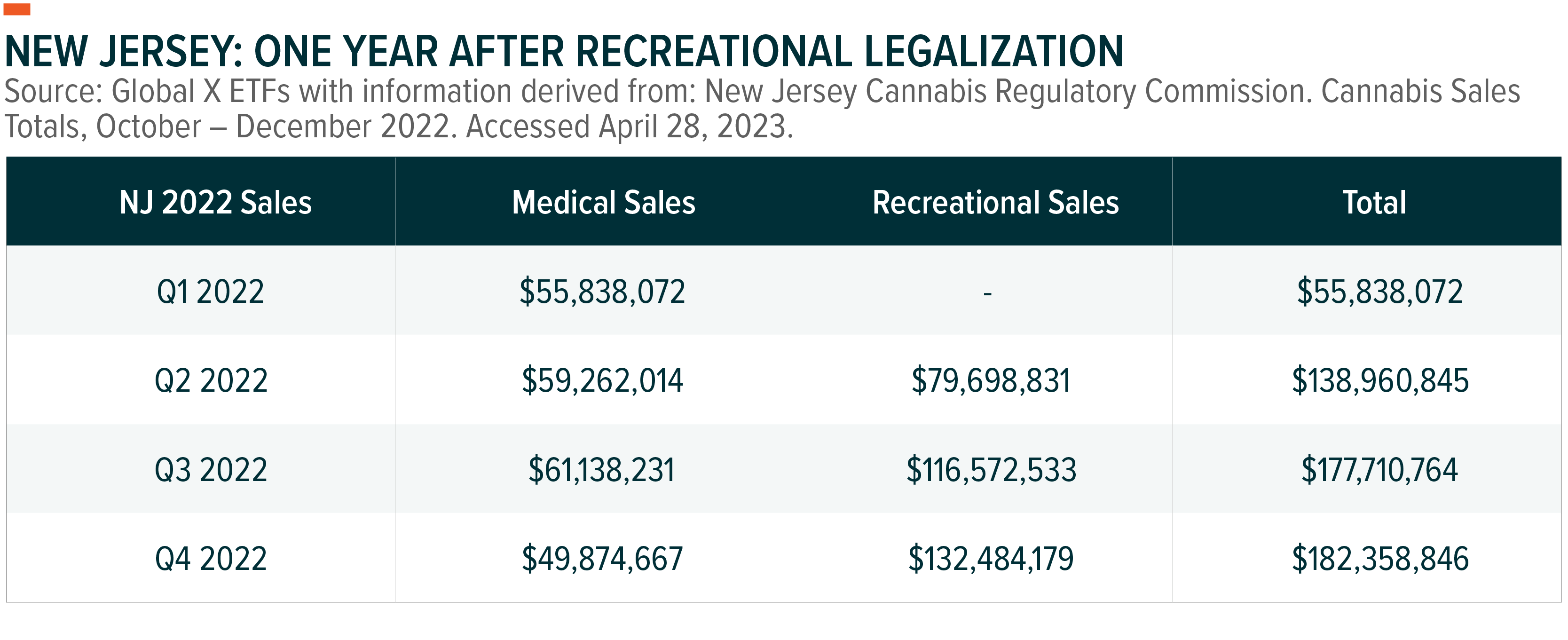

Without federal legalization, regulatory developments at the state level are key, and we continue to follow the ramp up of the cannabis industry in newly legalized sates. New Jersey launched its adult-use program in April 2022, and total sales in the populous state have increased rapidly.

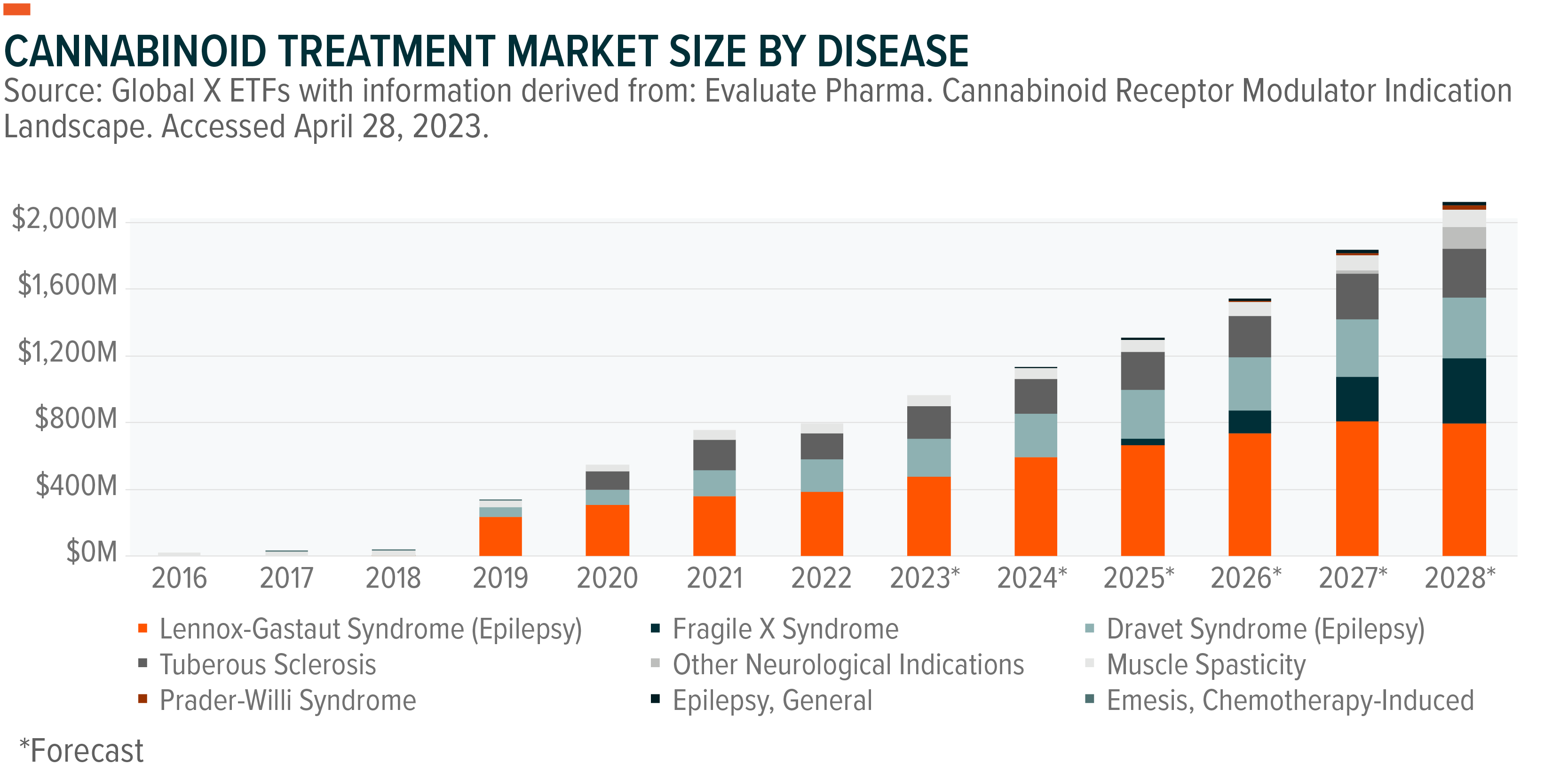

In the US, we also continue to follow the broader medical cannabis space, specifically the use of cannabinoids in FDA approved medications. The FDA has approved one cannabis-derived drug product, Epidiolex (cannabidiol), and three synthetic cannabis-related drug products: Marinol (dronabinol), Syndros (dronabinol), and Cesamet (nabilone).11 Given increasing interest in the space, the agency released updated clinical trial guidance in January 2023 for cannabis and cannabis-derived human drugs.12 These include resources for information on quality and control status considerations, as well as methods for researchers to calculate THC differences between hemp and cannabis. The guidance is expected to play a key role in more informed clinical research for cannabis drugs, possibly paving the way for additional cannabinoid drug approvals. The number of clinical trials with cannabis to treat illnesses continues to rise, with a particular focus on treating neuropathic and chronic pain, highlighting the vast potential of cannabis in pain management over the coming years.

Global Expansion: The Next Frontier

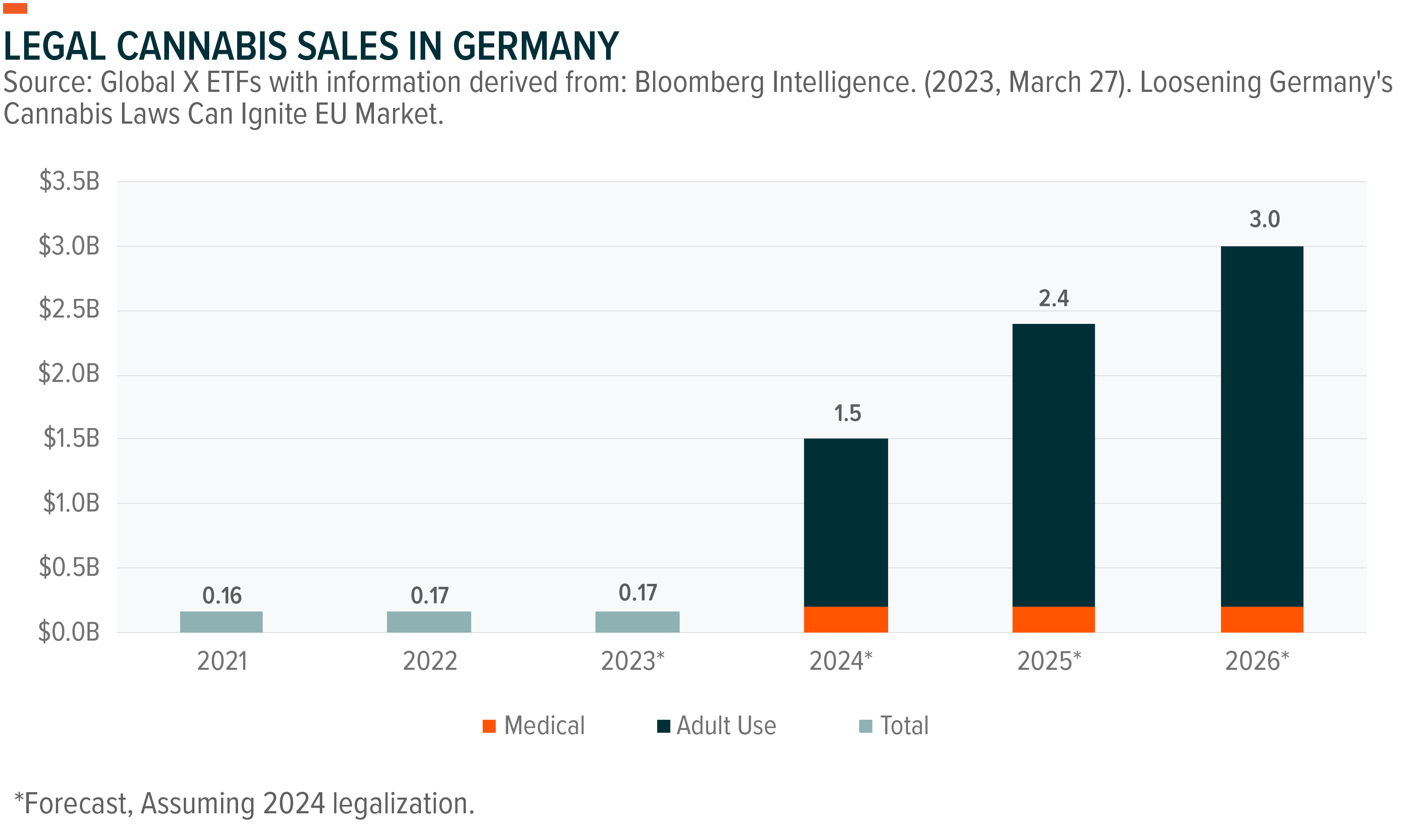

The German government recently unveiled its recreational cannabis legislation plan, which would allow citizens to cultivate, possess, and consume the drug for recreational purposes.13 The move has been long-awaited, as Germany’s legislative strategy on cannabis is expected to set the tone for how other European countries tackle cannabis legalization. If the law passes, Germany would become the largest country by population to legalize cannabis. The proposed plan shows a pared-down version of the original blueprint published in October 2022, as Germany’s draft framework was sent to the European Commission, the EU’s executive branch, for approval to ensure compatibility with EU and global drug laws. Though Germany had to rethink some of its strategies in the revised proposal, the move will likely play a key role in driving similar legislative change across European countries, potentially bolstering global cannabis sales. Germany’s cannabis market is expected to surpass US$3 billion in sales by 2026, assuming recreational sales are allowed in 2024.14 The European Union is working to further harmonize the European cannabis market, which we believe will play a key role in industry growth.

Conclusion

The cannabis industry has made huge strides in recent years, and we see a potentially long runway for growth ahead. However, given the large illicit market and complicated regulatory landscape, growth is unlikely to come in a linear fashion. Proposed legislation, such as the SAFE Act in the US and a potential framework for legalization in Germany, could add support to the industry but, in the meantime, companies are likely to remain focused on driving operational efficiencies and accelerating their paths to profitability. An uptick in M&A activity could also be seen, as established cannabis firms prepare for potential legalizations.

Related ETFs

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Arelis Agosto

Arelis Agosto